Fast Facts

Fast Facts

150 million Americans are considered ”Bank Challenged” (unbanked / underbanked).

The entire underserved population comprises more than a quarter of all U.S. households — some 68 million adults.

(Official US government figures)

However, other US government studies show "150 million Americans are considered ”Bank Challenged” (unbanked / underbanked)".

(FDIC Study Oct 2014)

(NOTE: 2000 Federal Reserve Bank study = 43 million. 2008 VISA study = 108 million)

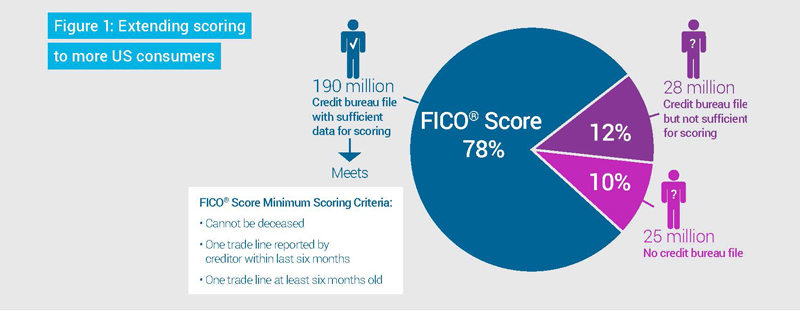

53 million people without a FICO credit score. 28 million consumers have files with insufficient data to meet these criteria. And more than 25 million consumers have no bureau file at all.

These two unscorable populations include many creditworthy individuals — people many financial institutions would welcome as customers.

[SWORD Tech gives you access to these people and many more. PLUS a management system to manage these people the banks consider non traditional non FICO score bearing consumers.]

From the FICO Decisions paper, Can Alternative Data Expand Credit Access?

“Bank Challenged” (unbanked / underbanked) Americans spend as much money on financial services as they do on food or roughly 10% of their income about $2500 - $4500/year.

(FDIC Study Oct '14)

An unbanked worker can spend $41,600 over a lifetime in check-cashing fees, the Brookings Institution, a liberal think tank, estimated in 2008.

In 2012, they (unbanked / underbanked) spent about $89 billion just on interest and fees for alternative financial services.

(AFS or Alternative Financial Services are defined as prepaid cards, check cashers, pawnshops etc)

We would say, "something is wrong with the banking system", wouldn't you?

In 2014, Financial Service Centers of America (FiSCA) estimates that non-bank financial transactions at outlets such as these account for $106 billion (over 350 million transactions) annually, and check-cashing services are responsible for over half of the industry's activity.

Check-cashing outlets are big business in the financial industry, with numbers on par with banks and credit unions. FiSCA counts about 13,000 outlets (FSCs) in the United States, 30% higher than economist John P. Caskey's tally of 10,000 using the Yellow Pages in 2000.

(Note: FiSCA is only one of several check cashing associations plus the many independents)

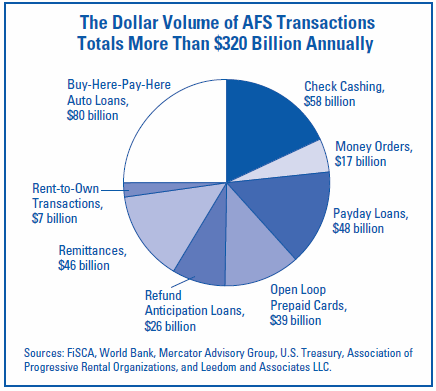

However, a 2009 FDIC Study shows the (total) amount spent to be $320 billion on interest, fees and other charges (thought to be service charges and penalties). Further, that figure is likely understated because it reflects only formally recorded transactions.

(Now here we are going on seven years later... you do the math!)

In May 2015, USPS admitted to losing $1.5 billion in its most recent fiscal quarter. If the losses keep up at this rate, the Post Office's budget deficit could surpass last year's $5.5 billion loss, and swell into a $6 billion annual deficit.

Restore basic bank services to America's Post Offices.

Postal banking has since gained traction with postal unions, which have been fighting to save the USPS — both by easing irresponsible congressional requirements for pre-payment of retiree benefits seventy-five years into the future and by expanding the range of services that post offices provide. In 2012, delegates to the National Association of Letter Carriers convention backed a resolution that declared, "A USPS bank would offer a 'public option' for banking." The new president of the American Postal Workers Union, Mark Dimondstein, wants the USPS to provide "a nonprofit alternative to the big banks" that "would give the working poor an alternative to the legal loan-sharking they are now victimized by. It also would provide another source of revenue."

(source: The Nation, Feb 12. 2014)

The white paper, released Thursday by the U.S. Postal Service Office of Inspector General, comes as the USPS is at a critical stage in negotiations with two of its unions. Postal unions are encouraging the agency to add more banking services to its portfolio, a model touted as successful at postal agencies in other countries. On average, posts in industrialized countries generated 14.5% of revenues from financial services in 2012, according to the report.

The report "outlines very clearly what's doable now," said Katherine Isaac, a consultant on this issue for the American Postal Workers Union. "It's a no brainer. The legal authority is there for expansion of numerous products and services." She said the union is also a proponent of adding additional products.

(Source Wall St Journal and USPS White Paper)

Since 2008, 93% of bank branch closings have been in zip codes with below-national median household income levels. Meanwhile, banks have been opening branches in areas with median incomes above $100,000.

(Source: The Pew Charitable Trusts)

A Pew finding shows that 71% of people view the US Postal Service favorably, compared to 9% for payday lenders, 21% for check cashiers and 56% for banks.

(Source: The Pew Charitable Trusts)

Enough said. The "fix" is obvious!

America needs a new basic bank product and secure national delivery system!